Fund Strategy

DISTRESSED DEBT

![]()

COUPLING MANAGEMENTS

The Three Key Managements

SynCore will purchase & restructure distressed real estate debt by coupling managements:

- Banking background

- Success purchasing distressed loans

- Real estate investing expertise

SynCore will primarily focus on purchasing loans in the $2 -$7 million range. This price point typically prices out ‘mom-&-pop’ investors but is below the threshold for larger private equity and/or hedge funds. Additionally, this price point allows us to purchase debt from less sophisticated lenders.

OUR INVESTMENT APPROACH

Market Driven Approach & Capital Preservation

» PRIMARY STRATEGY

The primary investment strategy is to purchase distressed real estate secured debt at a discount and apply restructuring strategies to maximize returns.

» SECONDARY STRATEGY

Secondary investment strategies are to purchase & stabilize distressed real estate, as well as originate high yield debt obligation secured by real estate.

WHAT WE DO

Below is a detailed breakdown of the investment approach, how we will source the deals and how we will stabilize the distressed assets.

The Manager will follow its core investment approach as follows:

Market Driven Approach

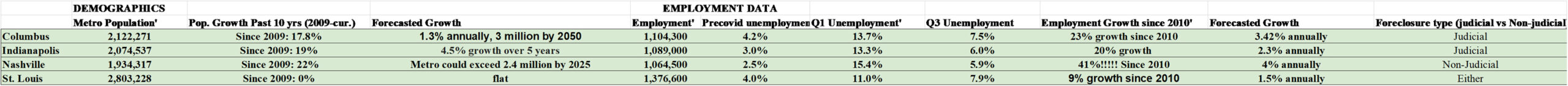

The Fund will invest primarily in the Mid Western US with a particular focus on Columbus, OH, Indianapolis, IN, and Nashville, TN, all with trends towards upward business and population growth. These cities are in addition to St. Louis & Kansas City, MO, given management physical location and resulting knowledge of these markets. *See chart at the end of this section.

Capital Preservation

The Fund will pursue opportunities that have built in downside protection and safeguards such as strong locations, defensible market positions, current or pre-leasing, proprietary strategies, strong sponsors and/or conservative capital structures.

Creative Sourcing

Off-market transactions, repeat partners, limited buyer pool, smaller unsophisticated lending institutions, locally marketed assets and tenant or customer driven transactions. Additionally, management will apply proprietary software to identify lenders most likely to divest of discounted loans or real estate.

Discount Oriented Investments

Attractive entry prices at discounts to underlying collateral value and replacement costs.

Asset Class Agnostic

The Fund may seek opportunities across all asset classes, assuming the discount and metrics are advantageous. The primary real estate assets classes include: office, retail, industrial, multi-family, self storage, and mixed-use.

FUND FOCUS

The Fund will focus its efforts on sourcing and acquiring distressed opportunities in the following areas:

Acquisition of Distressed Debt

The target asset is able to be purchased at an appropriate discount and have loan characteristics that are indicative of distress, including but not limited to:

- Performing and non-performing loans purchased at a significant discount to the underlying collateral

- Seasoned performing loans purchased at a discount to their payoff balance

- Loans with low loan-to-value ratios

- Loans that are in maturity default or have upcoming maturity dates

- Loans for which the borrower is unable to refinance or stabilize the underlying collateral

- Non-performing loans that are suitable for rehabilitation or for loan workout; o Non-performing loans purchased at a discount that appear likely to reinstate or payoff

- Performing or non-performing loans that have a low loan-to-value ratio that can be purchased at par value but have attractive underlying interest rates or are likely to result in the Fund obtaining ownership of the collateral

- Loans to borrowers in bankruptcy and/or receivership

Acquisition or Recapitalization of Distressed Real Estate

The target asset or business is in a distressed situation that will lead to a favorable acquisition price, including but not limited to:

- Assets displaying characteristics detailed above in the distressed debt section but for which the loans are unable to be acquired

- REO acquisitions from lenders

- Undercapitalized owners

- Mismanaged assets

- Assets in receiverships or bankruptcy

- Assets in foreclosure

- Failed projects or Timing issues

- Lender liquidity issues

Value & Cash Flow

Once an Investment has been acquired, the Fund will use the following strategies to maximize the value and cash flows of the Portfolio Investment until disposition:

- Special servicing of the distressed debt in order to restructure, modify, or otherwise cause the debt to re-perform for the purpose of retaining the debt in the Fund and/or reselling the debt;

- Special servicing of the distressed debt in order to facilitate a refinance, or payoff of the debt from the sale of the collateral real estate;

- Acquisition of underlying collateral through foreclosure for the purpose of rehabilitating, repositioning, operating and retaining the collateral;

- Foreclosure of the distressed debt in order to acquire and resell the underlying collateral;

- Foreclosure of the distressed debt to facilitate a restructuring of the subordinate debt, along with subsequent acquisition, stabilization, and retention of the real estate in the Fund;

- Acquisition of the underlying collateral through a structured workout, deed-in lieu or other settlement agreement;

- Restructuring of debt upon acquisition/recapitalization of an asset;

- Change in management;

- Leasing strategies to procure tenants and customers to generate revenue;

- Continual conversations with tenants, borrowers, customers, lenders and partners to stay on top of current information and be able to react swiftly;

- Continual hold/sell analyses to determine the most attractive time to exit;

- Identification of strategic partners and/or alternative exit strategies.